Bloom Energy (BE)

The Natural Gas Plant in Your Parking Lot

Bloom Energy (BE) sells a magic box that turns fuel into electricity without combustion. They call it the future of the energy transition.

The stock is up 400% in 2025 on the back of the AI data center craze. But when we at Helix look under the hood, we don’t see a hydrogen revolutionary.

We see a company selling natural gas generators at a premium valuation of 17x Sales, with a debt-to-equity ratio that would make a distressed debt trader blush. Is this the future of green energy, or just a very expensive way to burn fossil fuels in a parking lot?

The Deep Dive (beyond the paywall)

The “Green” Lie: Why 90% of their boxes run on natural gas, not hydrogen, and why their emissions math relies on a “marginal grid” fallacy.

The Valuation Vertigo: A look at how their Price-to-Sales ratio dwarfs their peers, despite a history of negative cash flow.

The Helix Position: We are fading the rally. Are you brave enough to hold it?

Bloom Energy: The Natural Gas Plant in Your Parking Lot

I remember the first time I saw a Bloom Energy Server. It was in the parking lot of a Silicon Valley tech giant’s UK data center.

It looked sleek, futuristic—like a monolith from 2001: A Space Odyssey. The facilities manager told me, This powers our data center with clean energy.

‘What’s the fuel?’ I asked. ‘Natural gas’, he whispered. I also enquired about their partnerships in the UK market, and how this contraption landed here.

That interaction perfectly sums up Bloom Energy (BE). It is a company that sells industrial appliances running on fossil fuels, but markets them with the fervor of a climate savior.

The stock has been on a tear recently, riding the AI needs power narrative.

But at Helix, we don’t trade narratives; we trade numbers.

And the numbers here suggest that investors are paying a Green Premium for what is essentially a Grey utility play.

1. The Economic Moat (or Lack Thereof)

We assess the moat by looking for a consistent, positive 5-to-10-year CAGR in Free Cash Flow (FCF) and Return on Invested Capital (ROIC).

Bloom fails this test spectacularly.

Cash Flow History: Since 2016, Bloom has been a cash incinerator.

2016–2021: consistently negative FCF.

2022: $-309 Million.

2023: $-456 Million.

2024: They eked out a small positive FCF (approx. $33M), but it looks like an anomaly driven by working capital shifts rather than core efficiency.

ROIC: Their Return on Invested Capital sits at a meager 2.59%. For a company that manufactures heavy hardware, this is dangerously low. They are spending dollars to earn pennies.

The Debt Burden Then there is the leverage. A healthy hardware company might have a Debt/Equity ratio of 0.5. Bloom Energy is sitting at 196% to 256% (depending on the metric used). They have over $1.3 Billion in debt against roughly $677 Million in equity. In a high-interest rate environment, this isn’t just a balance sheet; it’s an anchor.

2. The Greenwashing of Solid Oxide Fuel Cells

We ran Bloom’s sustainability claims through the ZeroCarbon Analytics framework.

They trigger the Hidden Trade-off and Transition Fuel red flags.

The Claim: We provide clean, resilient power.

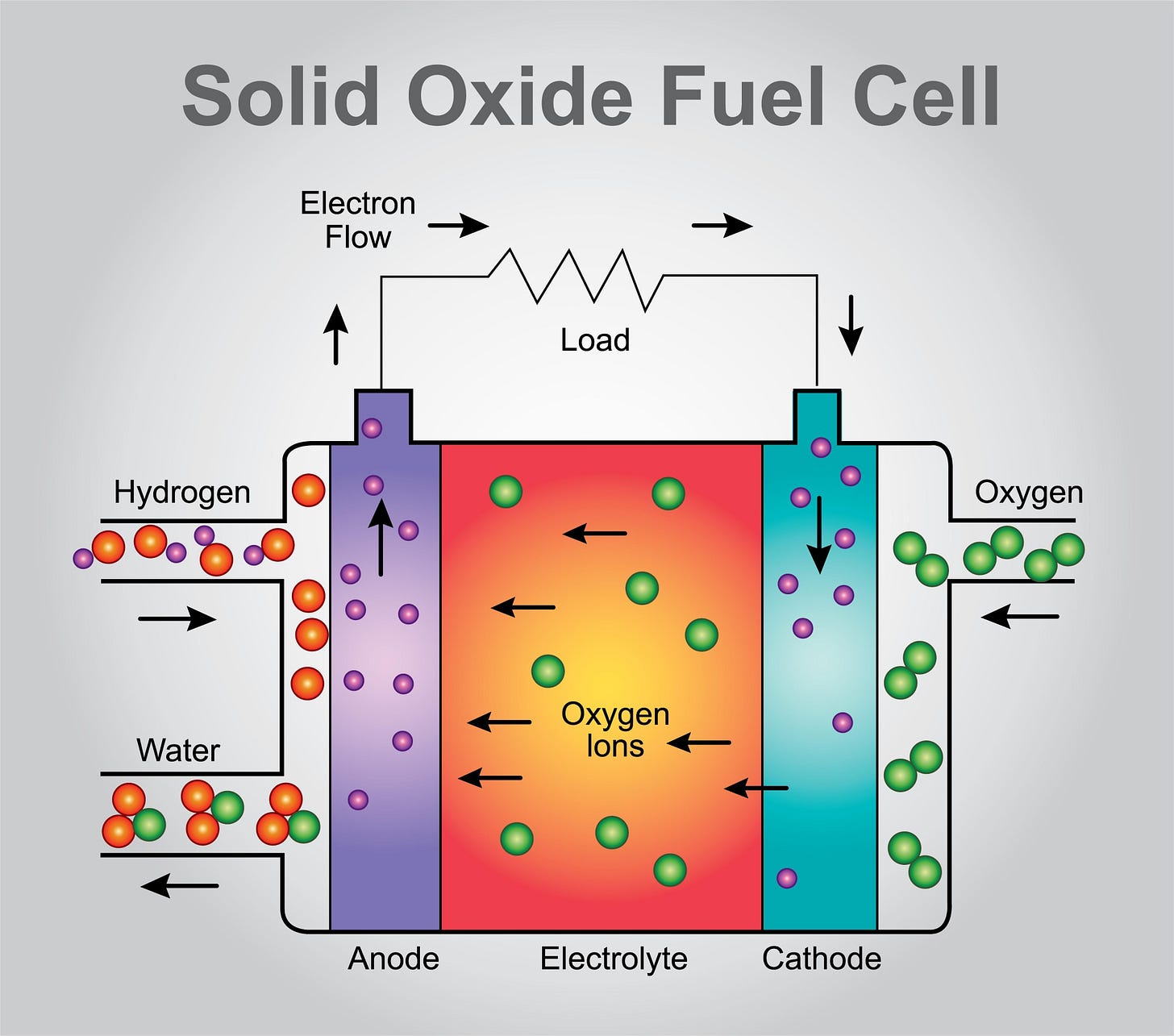

The Reality: Their Solid Oxide Fuel Cells (SOFC) can run on hydrogen.

But today? 90%+ of them run on natural gas.

Bloom defends this by comparing their emissions to marginal grid power (i.e., coal).

They say, We are cleaner than a coal plant!

That was a great argument in 2010. But in 2025, the grid is getting cleaner every day.

As solar and wind penetration increases, the marginal electron becomes greener. Bloom’s natural gas boxes, however, have a fixed emissions floor.

They are locking customers into a fossil-fuel infrastructure for 10-20 years.

To an ESG investor, this is a trap. You think you are buying the hydrogen future, but you are funding natural gas demand today.

3. The Valuation: Priced for Perfection

This is where the Helix team gets nervous.

We looked at the valuation not just today, but relative to the last 5 years and peers like Plug Power (PLUG) and FuelCell Energy (FCEL).

Price-to-Sales (P/S)

Bloom Current: ~17.4x (after the recent run-up).

Peer Average: ~3x - 5x.

Historical Average: Bloom typically trades at 3x-6x sales.

The Anomaly: You are paying nearly triple the historical average for a company with 14% gross margins and barely positive cash flow.

Price-to-Free Cash Flow

This metric is effectively Undefined or Negative for most of the last 5 years. The recent positive blip puts them at a multiple that is statistically meaningless (in the hundreds).

P/E Ratio

Trailing P/E is nonexistent (negative earnings).

Forward P/E is projected at a staggering 119x.

You are paying a software multiple (SaaS) for a hardware business (Generators). That disconnect usually resolves violently.

4. The Helix Position

At Helix, we are looking at this divergence: stock price up, fundamentals weak, and we are positioning defensively

.

What We Are Doing:

Fading the Rally: We believe the AI Energy trade has pulled forward too much demand for Bloom. We are reducing exposure or looking at put options to hedge against a valuation mean reversion.

The Long Short: We prefer longing the grid operators (Utilities) who will actually build the transmission lines for AI, and shorting the bridge solutions like Bloom that face terminal value risk from renewables.

The Question for You: Are you comfortable holding a Green Tech stock that is essentially a levered bet on natural gas prices, trading at 17x sales?

Or do you see the same emperor has no clothes risk that we do?

References