Nvidia: The “Green” Chip That Burns Coal

You’ve heard the pitch: AI will solve climate change.

Jensen Huang sells his new Blackwell chips not just as faster, but as “energy efficient.”

It’s a seductive narrative, isn’t it?

Buy Nvidia, save the world through better algorithms.

But if you look at the Scope 3 emissions data and the “circular revenue” structure of their venture arm, a different picture emerges.

What do you think of this summary?

Nvidia isn’t just selling shovels in a gold rush; they are selling coal-powered shovels to miners they also happen to be financing. If you think your Clean Tech ETF is safe with NVDA as its top holding, you need to read this.

The Deep Dive

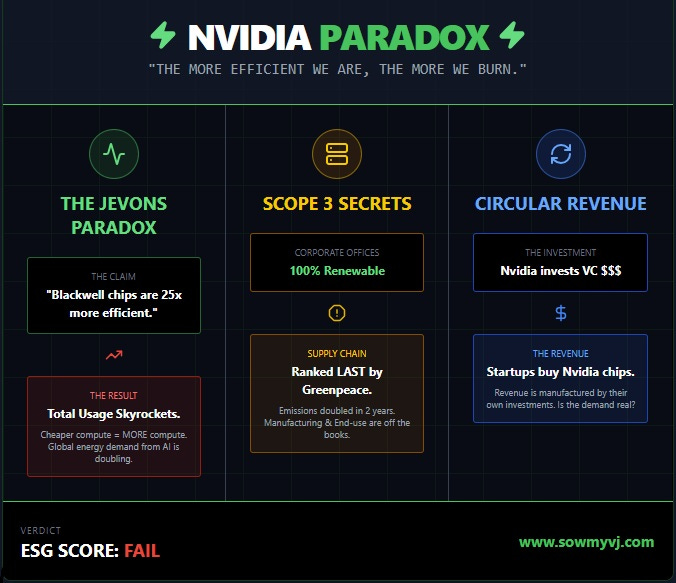

The Efficiency Paradox: Why making chips 25x more efficient is actually increasing global energy consumption (The Jevons Paradox).

The Supply Chain Dirty Secret: Greenpeace just ranked them dead last on supply chain decarbonization. We explain why.

The Circular Trade: How Nvidia invests in startups that turn around and buy Nvidia chips—and why that’s a governance red flag.

You can either review my book, and get a paid subscription in return, or choose to upgrade with the offer below.