Good morning/afternoon, everyone, and welcome to our live session. It's great to have our individual and institutional LPs joining us today. As many of you know, our investment thesis is deeply rooted in eco-economics, exploring the intricate relationship between ecological health, social well-being, and economic prosperity, as we consistently highlight here.

Today, we'll dissect recent market movements, look ahead to the key events this week, and discuss how these dynamics align with our long-term eco-economic perspective.

Looking Back: The Last One-Two Weeks

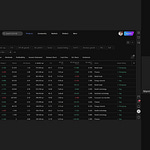

Let's start by reviewing the "Market Pulse" data from our partners, reflecting performance up to June 6th, 2025.

Equity Markets:

MSCI India: Demonstrated healthy growth, moving from 2,916 on May 30th to 2,957 on June 6th, representing a 1.37% weekly growth. This indicates continued strength in Indian equities.

Nifty 50: Similarly, the Nifty 50 saw a positive trajectory, climbing from 24,751 to 25,003, for a 1.02% weekly gain.

MSCI EM (Emerging Markets): Outperformed both, with a notable 2.21% weekly growth, moving from 1,157 to 1,183. This broad-based strength in emerging markets is a significant indicator.

Currency Markets:

USD/INR: Experienced a slight depreciation of the Indian Rupee against the US Dollar, moving from 85.53 to 85.79, a -0.31% change. This modest fluctuation is part of normal currency dynamics.

JPY/INR: The Japanese Yen strengthened against the Indian Rupee, moving from 0.5937 to 0.5922, a 0.26% change.

Net Flows (USD Bn):

FII/FPI (Foreign Institutional Investors/Foreign Portfolio Investors): We observed net outflows on a weekly basis (WTD) of $1.17 billion and on a monthly basis (MTD) of $0.42 billion. However, looking at the year-to-date (CYTD) figures, there's a significant net outflow of $15.55 billion. This is a key data point for us to monitor, as FII/FPI flows often reflect global risk sentiment and investment allocation decisions.

DII (Domestic Institutional Investors): In contrast, DIIs showed strong net inflows across all timeframes: $4.03 billion WTD, $2.97 billion MTD, and a substantial $36.19 billion CYTD. This robust domestic support has been crucial in mitigating the impact of FII/FPI outflows and underscores the growing resilience of the Indian market.

From an eco-economic standpoint, the continued domestic institutional investment is particularly encouraging. It suggests a growing localization of capital and a potential shift towards more sustainable domestic growth models, aligning with the principles of self-sufficiency and endogenous development that are core to our thesis. The strength in emerging markets, especially India, despite some foreign outflows, speaks to the underlying economic activity and potentially the resilience built through diverse economic strategies.

Upcoming Events This Week: June 9th - June 13th, 2025

Now, let's turn our attention to the immediate future and the "High Impact News and Macroeconomic Data" scheduled for this week. Understanding these events is critical for anticipating market volatility and opportunities.

Monday, June 9th (Past):

00:50 JPY Gross Domestic Product (QoQ) (Q1): This data provides insights into Japan's economic health, a crucial component of global trade and supply chains.

02:30 CNY Consumer Price Index (YoY) (May): China's inflation data is vital for assessing global demand and the health of the world's second-largest economy.

Tuesday, June 10th (Today):

07:00 GBP Claimant Count Change (May): An indicator of unemployment trends in the UK.

07:00 GBP Employment Change (3M) (Apr): Provides a broader view of UK employment.

07:00 GBP ILO Unemployment Rate (3M) (Apr): The official unemployment rate for the UK. These UK labor market figures will be closely watched for signals on the Bank of England's monetary policy stance, which can have ripple effects across global markets.

Wednesday, June 11th:

13:30 USD Consumer Price Index (MoM) (May): Monthly US inflation data, a key driver for Federal Reserve policy.

13:30 USD Consumer Price Index (YoY) (May): Annual US inflation data.

13:30 USD Core CPI ex Food & Energy (MoM) (May): Monthly core inflation, excluding volatile food and energy prices.

13:30 USD Core CPI ex Food & Energy (YoY) (May): Annual core inflation. The US CPI data is arguably the most significant economic release this week. Inflation figures will heavily influence expectations for future interest rate hikes or cuts by the Federal Reserve, which can significantly impact global equity, bond, and currency markets. From an eco-economics perspective, persistent inflation could signal imbalances in supply chains or resource allocation, necessitating a closer look at the underlying factors driving these price increases.

Thursday, June 12th:

13:30 USD Producer Price Index ex Food & Energy (YoY) (May): US producer inflation, an early indicator of consumer price trends.

Friday, June 13th:

07:00 EUR Harmonized Index of Consumer Prices (YoY) (May): Eurozone inflation data, crucial for the European Central Bank's policy decisions.

15:00 USD Michigan Consumer Sentiment Index (June, Prelim): A survey of consumer confidence in the US, which can provide insights into future consumer spending.

Regarding Earnings:

While the provided "High Impact News" calendar focuses on macroeconomic data, it's important to note that specific earnings reports for individual companies would be announced separately and are not typically part of a general macroeconomic calendar. For a detailed earnings outlook, we would rely on dedicated corporate earnings calendars. However, given the current macro environment, we anticipate that companies with strong fundamentals, sustainable business practices, and a clear path to generating value within an eco-economic framework will be best positioned to weather any market volatility. We continue to favor companies that demonstrate:

Resource Efficiency: Minimizing waste and optimizing resource use.

Circular Economy Principles: Embracing reuse, recycling, and regeneration.

Social Equity: Fair labor practices and community engagement.

Resilience to Climate Risks: Adapting to and mitigating environmental challenges.

Our Eco-Economics Thesis in Context

The data and upcoming events reinforce our eco-economics thesis. The volatility in global markets, driven by inflation concerns and central bank actions, underscores the interconnectedness of our financial systems with real-world economic and environmental factors.

Inflation and Resource Scarcity: Rising inflation, particularly core inflation, can highlight the strain on global supply chains and potentially signal resource scarcity. Our eco-economics framework emphasizes the need to transition towards more localized, resilient, and resource-efficient economies to mitigate these pressures.

Domestic Resilience: The strong DII flows in India exemplify a positive trend where domestic capital is increasingly supporting local growth. This aligns with our view that self-reliance and the development of internal economic strengths are crucial for long-term stability and sustainable development.

Policy and Sustainability: Central bank decisions, influenced by economic data like inflation and employment, have profound implications for capital allocation. We advocate for policies that incentivize sustainable practices and discourage environmentally and socially destructive activities. As LPs, your capital can be a powerful force in directing investment towards these transformative areas.

Conclusion and Q&A

In summary, while we observe normal market fluctuations and anticipate potential volatility from key economic data releases, particularly US CPI, our core eco-economics thesis remains robust. We continue to believe that long-term value creation will increasingly be tied to businesses and economies that prioritize ecological health, social well-being, and sustainable practices. The current market dynamics, far from being a distraction, provide further evidence of the urgent need for this paradigm shift.

We will continue to analyze these trends through the lens of our eco-economics framework, seeking opportunities to deploy capital in ways that generate both financial returns and positive societal impact.