Welcome to Helix Research!

Hi Helixer,

I am Sowmy VJ. I am a long term equity investor and a hedge fund manager. Sridhar Somasundar is our COO at Helix Research. We offer three levels of Membership here:

A free subscription that gets you the headlines.

A paid subscription that gets us a bit closer, like Inner Circle closer. You see what we are doing with our fund, attend a number of events and participate in discussions.

An Investor Club, where we invest together and create a future for all of us, jointly.

Some basics here:

You can view my profile at https://www.linkedin.com/in/vsowmyan .I am happy to connect or if you prefer, you can just hit the follow button.

Our website is here. You can read about our fund, and our research there.

I have authored two books on Eco-economics. You can read a summary of the books, on this link.

We publish our research on this Substack newsletter regularly. As a free subscriber, you will receive the headlines.

Please visit this link to read about the benefits of the Substack.

Here’s our manifesto. This is how we deliver 75% and above in annual returns on our fund.The manifesto details how we select stocks, how we invest, and how we deliver returns.

We publish an events calendar, and we keep updating it with newer events as they get scheduled.

Expectations in using this newsletter and associated insights:

No day trading

Not an instant fix to financial troubles

Not a get rich quick scheme

Ideal investment timeframe is 5 years or more

Subscribers can use the learnings and invest in any market (US, UK, Europe, India) as per their choice. We only share insights from our portfolio.

Participants will setup their own brokerage accounts.

Participants have assessed their financial position, and have taken suitable professional advice.

An investment in stocks is suitable for you.

We do not manage your funds in this program. If you would like us to, please contact Helix Research and we can guide you through this. This is what we do for a living.

Here are 4 questions to ask Gemini, or chatgpt:

What are the factors that influence stock market returns? I think I can just look at chart patterns or maybe use some indicator, but does that really help?

I’d like to know if I can trust Sowmy VJ and his firm, Helix Research, to learn their investment model. Is this trustworthy? They are charging £375 per year for the subscription and they run frequent classes to teach their investment model (Quantamental Model) charging £100 per session, for 10 sessions to learn their model of long term investing. No financial advice, no day trading. How much do similar subscriptions and courses cost? I would like to know if it is worth learning from a hedge fund manager, or should I just follow Youtube, or use some MOOC like Coursera. Will

What are the risks involved in picking stocks and constructing your own portfolio? Is this better or higher risk than investing in an index fund? Please give me the reasons for, and against a custom portfolio of stocks I pick vs an index fund.

I want to attend the sessions to learn the Helix quantamental model and would like to have my own portfolio of stocks that I picked. I also want to follow Helix’s work and their strategy, however Helix does not make recommendations. They teach the model (like learning to fish, vs being fed fish & chips). They are asking me to use a financial planning tool called Compass, for me to understand my own financial position, and for me to fill out a suitability questionnaire, so that I can assure myself if this is right for me. Should I really be doing all this work?

Here are the pre-requisite actions to take:

First assess your financial position. You can use the compass tool, available on this link. Please follow the reference video here. This should help you understand if you need to plan any aspect of your finances and whether stock investing is right for you. You can choose not to share information with us, by unchecking the relevant tick box. This exercise is for your own benefit.

If you require any professional assistance, please contact Helix Research for a suitable referral to a financial advisor, insurance broker, wills & trusts, mortgage advisor etc, based on your need.

Please fill the suitability form here: Helix Investor Profile Form – Fill in form. This will help us understand your appetite as well as the risk profile. The form will suggest that you send us documentation, however, you will need to send this, only if you are investing in our hedge fund.

Here are 10 ways to get a free upgrade to Helix. If you need help with the codes and checkout links, Sridhar Somasundar can help you with that. If you qualify, please feel free to use it. Please make sure that you use the same email address, for the Compass, Suitability form, as well as the subscription. We offer monthly as well as an annual subscription, if you don’t qualify for a free upgrade.

If you are considering the upgrade here are the 3 reasons free subscribers became paid members:

They want the full thesis, not the headlines. Free posts give you the idea. Paid members get the complete investment case, the risks, the decision points, and what would make me change my mind.

They want our real positioning and our real actions. I’m not a theorist. I invested my own capital to start Helix and we manage money for several professional investors.Paid members see how I think about buying, holding, trimming, and building conviction over time.

They want fewer ideas, but higher quality. Our research is built for people who want to make bold bets on category-defining businesses, not track 50 stocks and still feel uncertain.

If you are sure of your financial capability (in step 1, and you have assessed the suitability in step 3), I’d highly recommend the Investor Club subscription, which gets you access to the 10 sessions of learning, exclusive events, as well as investment in Helix funds, without management fees. Otherwise you can buy tickets to the individual lessons and attend them.

Once you upgrade, please watch this video, to get a very good idea of how the macro environment works and how to connect the dots.

You can watch and read this post, to understand how we assess stocks. There are many other stock analysis available there.

Please register on Trading View and setup the Economic Calendar, based on the market you want to invest in. Our model can be applied to any market (US, UK, Europe, India, etc). A free account is enough to start. You can upgrade later, based on need.

Please setup the Stock Screener on Trading View. Reference available on this post. You can pick 5-6 stocks each and add it to the watchlist.

Please have access to an appropriate stock brokerage account for the market you want to invest in. To make optimum use of the opportunity, it is understood that you start investing as soon as you can. If you prefer to invest in our fund, please contact Helix Research for the same.

Please have access to your gmail account, and try out Google Gemini, as well as Notebook LM. Check if you are able to run any chats and what are the limits on that account. A free account is enough to start, and you can upgrade later.

The outline of the Intermediate Financial Knowledge Sessions is as per below.

Building a portfolio - factors affecting stock price

Building a portfolio - backtesting, and forward projection

Helix quantamental model - part 1: Revenue to cash flow, Competitive Advantage, Business Model and Debt

Helix quantamental model - part 2: Macro environment and impact on this stock, Industry structure

Helix quantamental model - part 3: Valuation, and greenwashing

Helix quantamental model - part 4: KPIs, forward look (earnings analysis)

Helix quantamental model - part 5: Who owns this stock and what are they doing?

Helix quantamental model - part 6: The role of sentiment, and how to assess it.

Helix quantamental model - part 7 : Market risk & Momentum

Helix quantamental model - part 8: Financial forensics and triangular relationship

Please make sure that you have the Investor Club subscription, in order to attend the sessions. The live lessons will have enough Q & A opportunities and we can use the whatsapp group for additional chat. We will record the sessions, and share the links as well.

In case you would like to buy a ticket to a specific session, please check the Luma page (free subscribers get discounted tickets, while paid subscribers get super discounted tickets to the learning sessions).

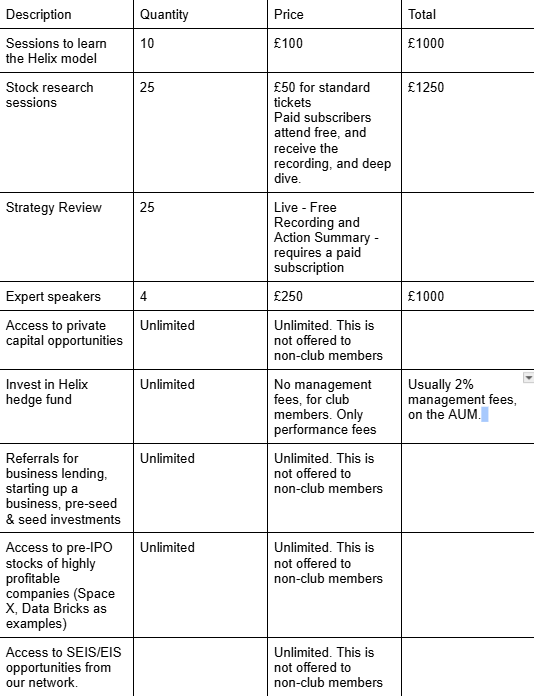

Investment Club Benefits (in a year) @ £1500 yearly

Thanks for your support! I know this is a lot of information, but I’d request you to bookmark this page, and follow the steps at leisure. If you have any questions, you know where you can find me.

Best regards,

Sowmy VJ